In this article, we continue our exploration of how pharma builds and proves value for the payer audience.

In PART 1, we saw how to “make it matter” to payers.

We learned that it is critical to get on their radar in the midst of their many other priorities.

In our case study, our pharmaceutical manufacturer made enlarged prostate (EP) a medical condition that should matter to payers by showing them 1) it was highly prevalent in their population and 2) it was costing them money in adverse events like acute urinary retention (AUR) and prostate-related surgery. (FULL POST HERE)

In PART 2, we saw the importance of building the value in payers minds of our specific service type.

For our drug manufacturer, this meant highlighting the value of their drug’s class over other drug classes used to treat the same medical condition.

We learned the principle of “class differentiation,” and how our drug maker highlighted how the class of their medication was superior to another class of medication used in the condition. They did this by proving that 5ARIs are superior to ABs in terms of limiting prostate-related surgeries and AUR events in men with EP. For the independent medical practice owner, this means highlighting the value your branch of medicine delivers to the payer audience. (FULL POST HERE)

In the first 2 parts, we laid a strong foundation for our ultimate goal – product differentiation –that we have THE solution for payers.

That’s what we’ll explore here in the final part of our 3-part series.

PRODUCT OR SERVICE DIFFERENTIATION

After showing that EP matters to payers, and that their product’s class has benefits that exceed those of other classes used to treat EP, our drug maker was ready to demonstrate their product was the product of choice for treating EP.

You may recall that our drug manufacturer’s product is a member of the class of medications called 5ARIs. While ABs are also used to treat EP, they are inferior to 5ARIs. Specifically, patients experience more AURs and prostate-related surgeries when treated with ABs than 5ARIs.

That was great for the 5ARI class, but for the makers of dutasteride, they needed more. They needed a way to highlight why their product is the product of choice… especially when the only other competitor is a generic.

You may recall that during our class differentiation effort, the drug maker realized there would not be enough dutasteride-specific data in the databases because dutasteride had not been on the market long enough.

However, once dutasteride had been on the market for a couple of years, there would be enough data to make individual product comparisons…

And that’s exactly what dutasteride’s maker did.

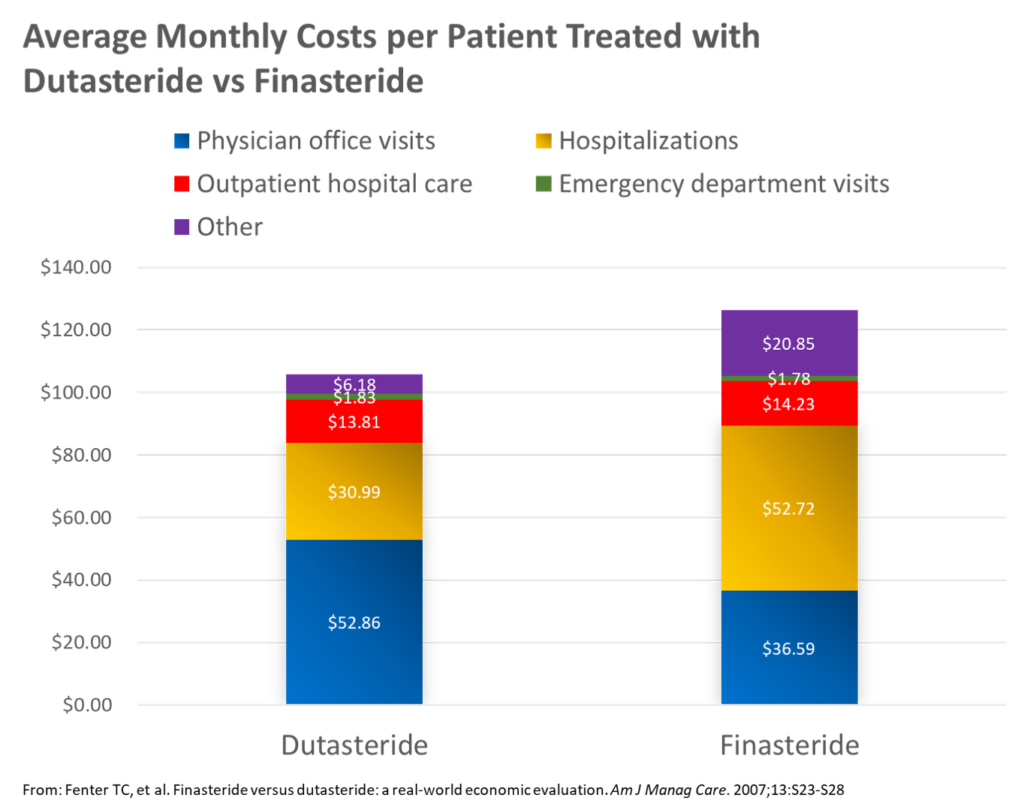

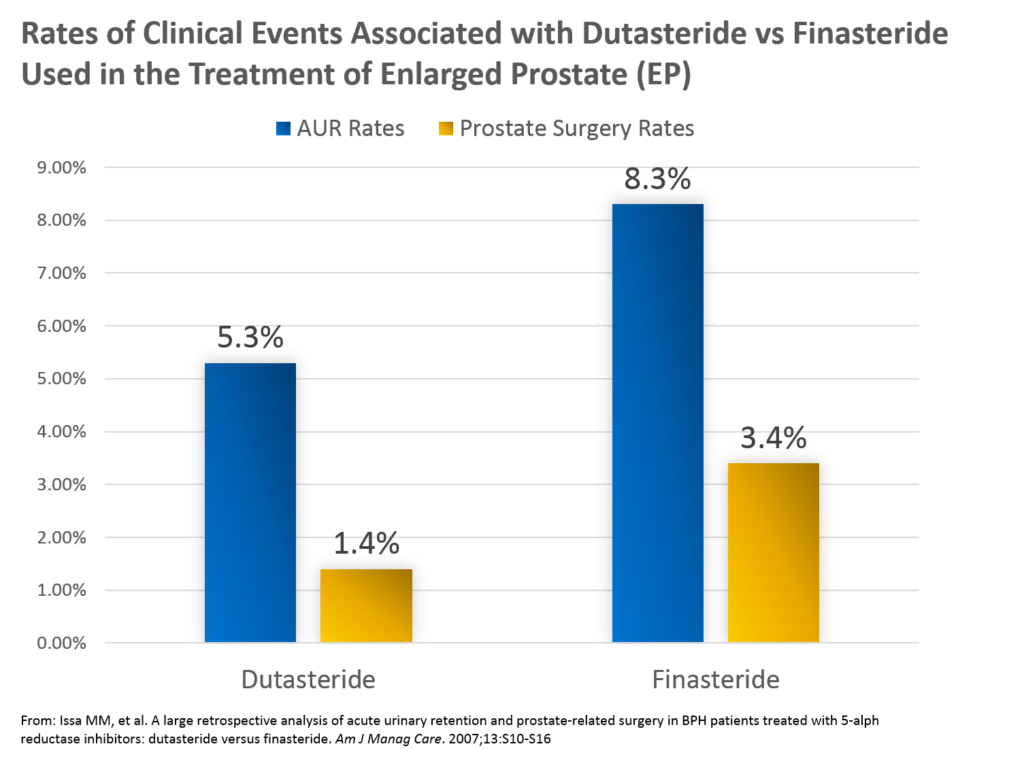

Here’s the data (find the full publications HERE and HERE, respectively):

Key insights from these analyses included the following:

1. Dutasteride was associated with a lower rate of AUR than finasteride – 5.3% vs 8.3%, respectively

2. Dutasteride was associated with a lower rate of prostate-related surgery than finasteride – 1.4% vs 3.4%, respectively

3. Average monthly medical claims costs were lower in men with EP treated with dutasteride ($106) vs finasteride ($126)

APPLICATION TO THE INDEPENDENT MEDICAL PRACTICE

So how can you apply product differentiation to your independent medical practice?

It is true that you will not duplicate this approach as you compare your clinic’s results with that of another. You simply won’t have the data from a competitor to do so.

However, remember that your ultimate audience is the payer.

And the payer IS looking at your clinic in terms of its performance compared with other clinics.

Thus, the best application of the principle of product differentiation to the independent medical practice is to highlight the value that your clinic is routinely providing to the payer… and PROVE it!

(Of note, you can download your FREE copy of our complete introductory guide to building a payer value proposition, titled “How to Motivate Payers to Increase Your Reimbursements” for step-by-step guidance by clicking HERE.)

Of course, you know that you deliver quality care to payers each and every day.

You know that you provide a valuable service to patients that also brings value to payers.

But you aren’t necessarily PROVING that every day.

Rather, you are very busy with running the details of your clinic… seeing patients, coding and billing, handling rejections, scheduling, etc.

However, the need to actually prove your value to payers is growing.

You are going to apply this principle by simply standing out among the crowd of so many other clinics.

You will do this by building a payer value proposition.

There are 4 steps in the process that include the following:

1. Identify your target metrics

2. Pull your data for target metrics, and evaluate findings

3. Create “marketing” messages

4. Communicate the results.

STEP #1: Identify Target Metrics

First, you want to identify your target metrics to include in your payer value proposition.

With so many potential metrics, you may wonder which metrics to include.

Here’s a hint – think about what matters to the payer.

Payers are focused on many metrics and groups of metrics. For example, they are always interested in things like hospitalization rates and ER utilization rates. The use of those healthcare resources costs them a lot of money.

In addition, there are sets of quality metrics that have real implications for their financial health. The Medicare STAR program allows Centers for Medicare and Medicaid Services (CMS) to drop carriers that do not meet a minimum STAR score threshold.

The National Committee of Quality Assurance (NCQA), an organization that accredits health plans, can avoid or pull their seal of approval for any plans that do not meet their standards.

STEP #2: Pull Your Data for Target Metrics, and Evaluate Findings

Once you have identified your list of target metrics that are aligned with payer interests, you are ready to pull your own data and see how you stack up.

Most of this data is already available in your existing practice management (PM) and/or electronic medical record (EMR) systems. You simply need to narrow your data pull to the right population (e.g., patients with diabetes and Medicare) and run some basic descriptive analyses (e.g., mean, median, quartiles).

Once you have your data, you can evaluate your clinic’s results against the standard from STEP #1.

For example, if the quality metric standard is a population average HgbA1c <9.0%, you can make sure your clinic’s average is below that standard.

STEP #3: Create “Marketing” Messages

For those areas in which you find “win-wins,” meaning the metrics is important to payers AND your clinic delivers great results, you create your marketing messages.

Yes, I said “marketing” messages. I know it seems odd that we market to payers. However, this is done more often than you might think. Pharmaceutical manufacturers have teams of personnel who strategize and create marketing materials specifically for the payer audience.

Of course, this kind of marketing looks quite a bit different than the direct-to-consumer (DTC) type of advertising we are all bombarded with constantly.

In fact, there are a couple of key principles that should be our foundation for marketing to payers. They include the following:

Key Principles of “Marketing to Payers”

- Data-driven and supported messages

- Appealing to the responsibilities of population management rather than the emotions involved in treating individual disease

So why do you need to create messages at all? Why not just send the data charts directly to your payer contact with your request?

Well, just like most marketing, it helps to be as direct as possible!

Instead of counting on your contact in the contracting department at the health plan to make the connection on their own, you are best off by being as explicit as possible in communicating the value your clinic delivers.

In our case study we identified several key facts that support a payer value proposition. They include the following:

1. EP is a highly diagnosed condition in the population of men ≥50 years of age (in the top 10, along with diabetes and hypertension)

2. Poorly managed EP is associated with 2 costly events – 1) prostate surgery, and 2) AUR

3. EP is in the top 10 most commonly diagnosed conditions in this patient population (men ≥50) – ultimately, it was #4 on the list

4. Average annual expenses for the payer are similar for their EP patients ($401) to their diabetes patients ($463)

5. Average annual expenses for the payer for their EP patients is nearly double that of their hypertension patients ($213)

6. Rates of AUR were greater in those treated with AB (12.6%) vs 5ARI (8.2%)

7. Rates of prostate-related surgery were greater in those treated with AB (6.0%) compared with those treated with 5ARI (3.7%)

8. Average monthly medical claims costs were lower in men with EP treated with dutasteride ($106) vs finasteride ($126)

Now you want to think about how these findings align with payers’ interests.

Admittedly, these are not hospitalization, re-hospitalization, or ER utilization data. Furthermore, there are no quality metrics in the management of EP.

However, the data listed above DO highlight clinical and economic benefits for the payer. If they believe that rates of AUR and prostate-related surgery are lowest in men with EP treated with dutasteride vs finasteride or ABs, the drug manufacturer has succeeded in positioning their product as THE solution.

Thus, we can write messages such as:

1. EP is the 4th most prevalent diagnosis in men 50 and older

2. EP is commonly associated with adverse events like acute urinary retention (AUR) and prostate-related surgery (19% annually)

3. The 5ARI drug class is associated with a lower rate of AUR and prostate-related surgery than the AB class (3.7% vs 6.0%)

4. Dutasteride is associated with the lowest rates of AUR and prostate-related surgery than finasteride

- AUR: dutasteride – 5.3%; finasteride – 8.3%

- Prostate-related surgery: dutasteride – 1.4%; finasteride – 3.4%

5. Average monthly medical claims costs were lower in men with EP treated with dutasteride ($106) vs finasteride ($126)

STEP #4: Communicate the Results

In the last step, you will simply want to communicate your results to your payer audience.

You will pull together your marketing messages in support of the value you bring and deliver that to the payer.

For our drug manufacturer, these messages were pulled together into many different format to reach the payer. They were published in the medical literature, they were put into presentations, they were detailed in bifolds and mailings, etc.

Building a payer value proposition is described in much greater detail in our FREE eBook – How to Motivate a Payer to Increase Your Reimbursements – Get your FREE copy HERE…

CONCLUSION

In this final article in our 3-part series exploring how pharma builds value for payers in support of their drug products, we learned how to differentiate a product.

In the pharma world, that means we compare Drug A vs Drug B and proving the value of our drug versus another in terms that payers care about. Specifically, things that cost payers money like expensive clinical events (e.g., hospitalizations) or are tied to standards they must meet (e.g., Medicare STAR, NCQA).

Of course, for the independent medical practice owner, it would be rare to have comparative data with another clinic.

However, the principle can be applied by building your case for your own clinic. While this can be done with a great variety of different data types, keeping one principle in mind will guide you in figuring this out – think about what matters for from the payer perspective… then you can align how your clinic delivers that value to them.

For a much deeper presentation of building a payer value proposition, download our FREE eBook, How to Motivate Payers to Increase Your Reimbursements HERE.