Do you know how the pharmaceutical industry (i.e., “pharma”) proves value to payers?

They’ve been doing it for decades to help sell billions of dollars of medication.

Once they convince payers their product has value, they drive prescribing by practitioners which ultimately drives drug product sales.

But how do they convince payers in the first place?

This article is the first of a 3-part article series that will illustrate how pharma builds value propositions for payers.

You can download a FREE copy of our eBook – How to Motivate Payers to Increase Your Reimbursements HERE for a more detailed introductory guide of how to build a value proposition.

But here, we are going to examine a textbook case of how Pharma does this so well. In doing so, we are going to gather insights that we can apply to the independent medical practice setting.

Let’s get started…

THE CASE STUDY

We will start with a summary of the situation.

Our drug manufacturer has a product used in the treatment of a condition called benign prostatic hyperplasia (BPH), or enlarged prostate (EP).

The drug was a member of a drug class known as the 5-alpha reductase inhibitor (5ARI) drug class called dutasteride. In the mid-2000’s, there was only one other marketed agent in this class known as finasteride.

Beyond the 5ARI class of medications, another class of drugs known as alpha blockers (AB) was commonly used to treat patients with EP. Yes, the same class of drugs used to treat high blood pressure is also used to treat EP. Some of the most common drugs in this class are alfuzosin, doxazosin, tamsulosin, and terazosin.

In short, the makers of dutasteride knew they had a problem with payers.

There were already cheap gerneric ABs on the market. Plus, Finasteride had a looming patent expiration. Thus, dutasteride would be particularly unattractive to payers unless they figured out a way to prove the value of their product to command the premium price they wanted.

And they did…

WHO CARES ABOUT ENLARGED PROSTATE?

Not payers…

Quite frankly, EP as a medical condition was completely off the radar for payers.

Why would they pay attention to EP when they are focused on therapeutic areas like hypertension and diabetes that impact so many more of their members and subsequent health care claims? The burden to the payer of hypertension and diabetes was perceived as much greater than that for a niche diagnosis like EP. As such, the management effort focused on the former.

Because EP did not carry a heavy clinical burden to the payer (or so they believed), their management of EP medications was purely a dollars and cents issue.

Their logical approach would be the following:

1. Favor generic ABs in the treatment of EP

2. Favor finasteride (a generic) over dutasteride (an expensive branded drug) in the 5ARI class

Given this market situation, the makers of dutasteride needed a way to “make EP matter” to payers.

Believing that they had a superior product to offer as a solution to EP patients, they needed to elevate the problem in payers’ minds.

MAKING PAYERS CARE

In our case study, the manufacturer followed a very typical path to get noticed.

Specifically, they looked to “build the burden” of EP.

More specifically, they looked to build this burden with credible data. Payers routinely use data to make population-based healthcare decisions. Thus, credible data is fundamental to speaking their language.

In our case, compelling data to highlight the actual burden of EP, a condition they were likely ignoring, was a logical first step in ultimately building interest in their product as a solution to the problem.

The manufacturer accomplished this with a retrospective database analysis study that highlighted a couple of key facts:

1. EP is a highly diagnosed condition in the population of men ≥50 years of age (in the top 10, along with diabetes and hypertension)

2. Poorly managed EP is associated with 2 costly events – 1) prostate surgery, and 2) acute urinary retention (AUR)

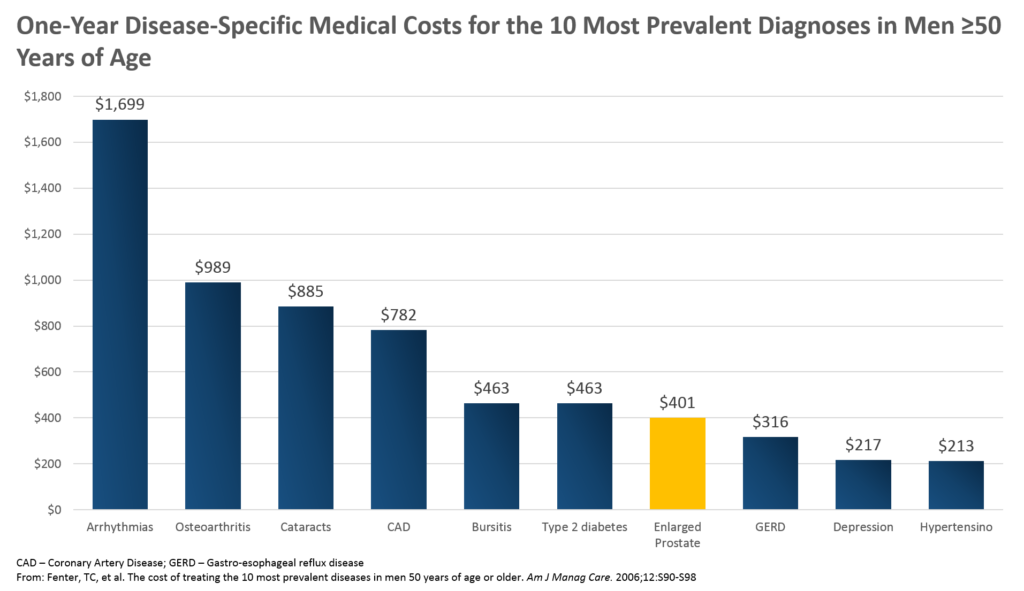

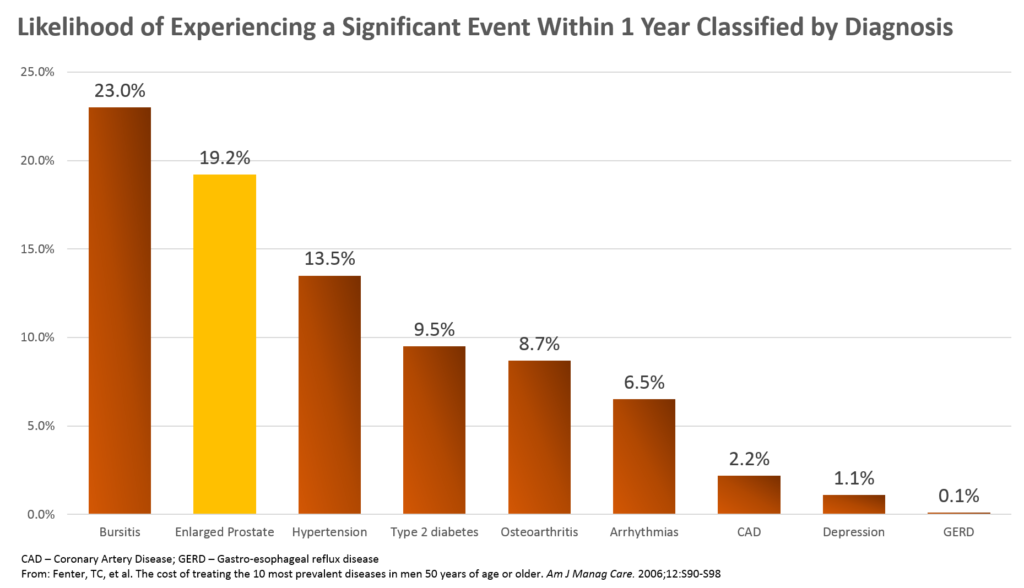

After the process of designing these studies, pulling the data, and doing the analysis, the results were published in a medical journal in the public domain. Here are the key tables from the publication (available HERE):

Some of the key insights from this chart for the payer perspective, and thus, a focus for the drug maker, are the following:

1. EP is in the top 10 most commonly diagnosed conditions in this patient population (men ≥50) – ultimately, it was #4 on the list

2. Average annual expenses for the payer are similar for their EP patients ($401) to their diabetes patients ($463)

3. Average annual expenses for the payer for their EP patients is nearly double that of their hypertension patients ($213)

Key findings from this figure are the following:

1. The likelihood of experiencing an adverse event within 1 year in EP patients was #2 on this list and above those that may occur in patients with hypertension, diabetes, arrhythmias, and more

2. The likelihood of a member with EP having either prostate surgery or an acute urinary retention (AUR) episode within a year was 19.2%

Producing the data was the key first step.

Afterwards, these data were packaged in several different formats and put in front of the payer audience. They were reproduced in brochures, bifolds, slide decks for presentation, and more.

All of it got the payer thinking about how EP is likely costing them more than they realize, and that they should take a closer look at the therapeutic area.

APPLICATION TO THE INDEPENDENT MEDICAL PRACTICE

So how can we apply this principle to the independent medical practice setting?

It’s true that you will not need to “build the burden” of the problem for which you are already an acting solution. Meaning, you do not need to profess to the payer that there are significant clinical and economic consequences possible across all of the medical conditions you treat at your clinic.

Rather, there is an overall burden of healthcare that is already a perceived crisis that is looking for solutions.

But that’s the key. You have the opportunity to position yourself as one of those solutions.

In your case, however, the principle of “making it matter” may be critical for the following reasons:

1. Payers may view your medical practice business as “under the radar”

2. Payers may not be actively looking to differentiate individual practices (yet)

In the pharmaceutical world, there are some diseases that are so rare, the payer chooses not to spend their time managing those diseases. Rather, they process healthcare claims for those patients in a transactional way, void of significant hurdles to qualify them for treatment beyond the right diagnosis.

For example, in hereditary angioedema (HAE), a rare inherited disease that causes considerable swelling in body tissues, there are treatments that cost in excess of hundreds of thousands of dollars per year.

The payer might gripe, but they won’t deny a treatment to the unfortunate 1 in every 50,000 members who has HAE. The small number of patients using these expensive therapies makes them relatively cheap compared with much more common conditions. The thousands of patients with hypertension and hundreds that have heart attacks each year cost them significantly more in healthcare claims because of their volume.

This scenario may well describe your independent medical practice, too.

Because there are so many medical practices in payers’ networks, a single practice can easily be functioning “under the radar.”

While this may have been acceptable in the past when payers simply processed claim after claim for every practice, the macro-trends indicate this era is coming to a close. In its place is a greater level of scrutiny on the expense that each practice represents for the payer along with the value they actually deliver to the payer.

The demand from proof of value for payers is only growing. Technology will continue to give payers greater insights into what they are actually getting from each provider in their network. If it is good value, the provider is in good shape. If not, the consequences for the independent practice may be significant… even life-threatening.

While it may be comfortable to fly “under the radar,” today presents an opportunity to get noticed for doing things well.

CONCLUSION

In this 3-part series on how to prove value to a payer for a product or service, we are taking a look at how pharmaceutical manufacturers prove value to payers.

In doing so, we are gathering key insights that we can apply to the independent practice setting.

After all, these principles help drive billions in profits for drug companies.

In this PART 1 article, we learned how therapeutic areas that matter to manufacturers or providers fly under the radar of payers’ larger healthcare utilization control interests. We realized that there is an opportunity (and sometimes a need) to get our voice heard.

In the pharmaceutical world, that means “building the burden” of disease. It means making something that didn’t matter to the payer perspective suddenly matter.

We do that with compelling data and insights they likely are missing among their competing priorities.

The application for the independent practice is to consider how their relatively small business truly does filter up in bigger ways to bring value to the payer. The payer may not be routinely reviewing the impact of your business on theirs simply because your volume is small when compared with ALL that they manage. However, the independent medical practice has a great opportunity to make sure it stands out.

Click HERE to go to PART 2, “Class Differentiation”…

You can download a FREE copy of our eBook – How to Motivate Payers to Increase Your Reimbursements HERE for a more detailed introductory guide of how to build a value proposition.