We are continuing to explore a textbook case of how pharma proves value to the payer audience.

This is PART 2 in a series of 3 articles exploring a textbook case of how a drug manufacturer proved value to payers in a compelling way.

In PART 1, we learned how to get on the radar of payers. We learned how important it is to “make it matter” to payers.

(Click HERE if you missed PART 1)

In PART 2, we are going to extend our review of the case study in the use of dutasteride in the treatment of enlarged prostate (EP).

REVIEW OF “BUILDING THE BURDEN” OF EP

In the first part of this series, we saw how the manufacturers of dutasteride were challenged to make EP “matter” to the payer audience.

This process is called “building the burden,” and it is quite typical of any therapeutic area that is “off the radar” of managed care.

Pharmaceutical companies have this issue often since they develop drugs for many more diseases that the 10 most prevalent in the world.

(You’ll have it too with your independent medical practice given the volume of practices and physician groups payers manage.)

Essentially, with the thousands of diseases payers manage in their populations, they are focused on the ones that are most visible – both in terms of disease prevalence and costs. Diabetes and hypertension are two examples.

In PART 1, we saw that the drug maker did some research that highlighted several key points about EP that elevated the importance of this medical condition to the payer audience:

1. EP is a highly diagnosed condition in the population of men ≥50 years of age (in the top 10, along with diabetes and hypertension)

2. Poorly managed EP is associated with 2 costly events – 1) prostate surgery, and 2) acute urinary retention (AUR)

3. EP is in the top 10 most commonly diagnosed conditions in this patient population (men ≥50) – ultimately, it was #4 on the list

4. Average annual expenses for the payer are similar for their EP patients ($401) to their diabetes patients ($463)

5. Average annual expenses for the payer for their EP patients is nearly double that of their hypertension patients ($213)

Once the relevance of the disease state was proven with compelling data (meaning both higher prevalence than anticipated and higher costs for the payer). The foundation was laid for the next step in the process – “Class Differentiation.”

With class differentiation, we are starting to position our product as a viable solution to the problem of EP.

CLASS DIFFERENTIATION

So what is “class differentiation?”

As you know, every pharmaceutical drug belongs to a certain “class” of medications.

Drug class is defined as “a group of drugs that have certain things in common and work in a similar way.”

Remember, in our case study, we saw that there were two primary classes of medication used to treat EP – 5α-Reductase Inhibitors (5ARIs) and alpha blockers (ABs).

In the 5ARI class, there was only 2 options – our drug dutasteride and its predecessor finasteride.

In the AB class, there were several branded and generic treatment options.

“Class differentiation” is simply the act of demonstrating or proving differences in outcomes between these classes in some way.

Was there a reason to think there would be differences in outcomes associated with these two classes?

Absolutely…

Specifically, both 5ARI agents showed in clinical trial settings that they helped reduce the rate of 1) prostate-related surgery and 2) acute urinary retention (AUR) episodes in men with EP.

Those are meaningful outcomes for a payer both clinically and economically – an AUR emergency costs about $500 per episode and a prostate surgery about $10,000.

Furthermore, ABs did NOT have such data. In fact, the whole AB class was much more associated with treating the symptoms of EP (e.g., difficulty urinating) vs altering the progression of the disease.

So what was known about these medications from clinical trials set up the rationale to expect similar results in a “real-world” setting – the payer’s setting.

There was one more important hurdle to consider in our case study.

Dutasteride was fairly new to the market.

As such, during the time the manufacturer wanted to generate this kind of data to show the impact of dutasteride on clinical events in the real world, there would not be enough data in the payers’ data sets to complete proper analyses.

The work-around was to demonstrate “class differentiation” between the 5ARI and AB classes.

This approach allowed any analysis of the 5ARI class to include both dutasteride and its other member, finasteride, a drug that had been on the market for many years prior.

As such, the data on its utilization and the outcomes in patients treated with finasteride were available in payers’ data sets.

So the manufacturer designed and executed a retrospective database analysis in payer claims comparing the rates of prostate surgery and AUR in patients with EP.

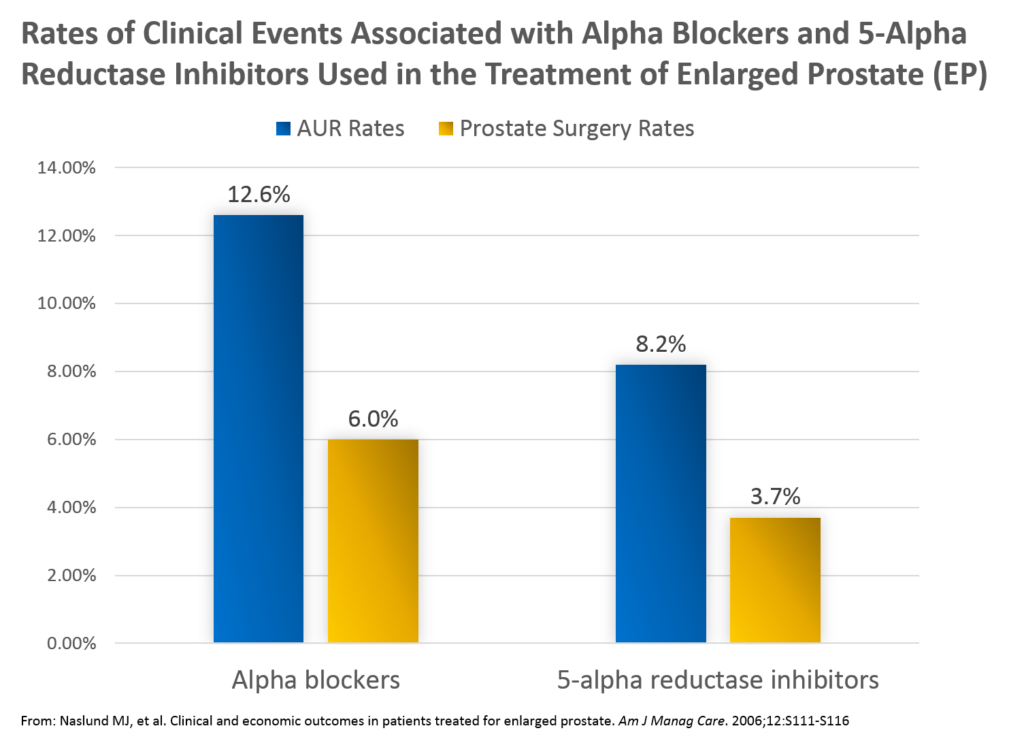

Here’s what the results looked liked (publication link HERE):

Key findings from the studies included the following:

- Rates of AUR were greater in those treated with AB (12.6%) vs 5ARI (8.2%)

- Rates of prostate-related surgery were greater in those treated with AB (6.0%) compared with those treated with 5ARI (3.7%)

In general, this study was important in that it showed the impact of 5ARIs in the “real-world” setting did mirror that seen in the more controlled, clinical trial setting for finasteride and dutasteride.

At a population level, fewer prostate surgeries and AURs resulted when patients with EP were treated with 5ARI medications.

APPLICATION TO THE INDEPENDENT MEDICAL PRACTICE

So how can we apply what we learned about the pharmaceutical industry to the independent medical practice setting?

Consider the benefits that your particular “class” of medical services returns to the payer.

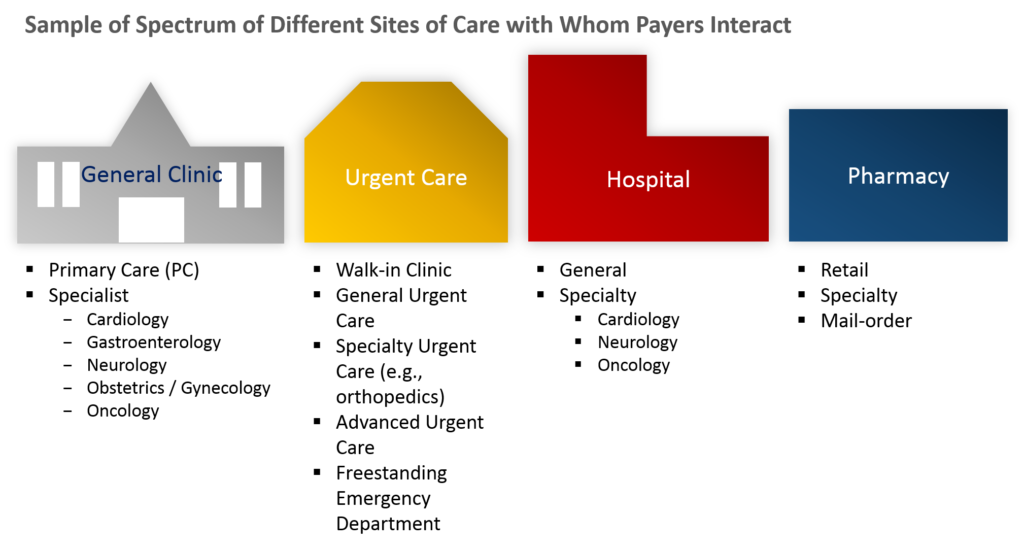

Healthcare products and services are delivered across MANY different types of sites of care.

Consider for a moment how the payer is paying for the delivery of healthcare products and services across so many different sites of care.

Now, if you are the payer, are you sure that they are ALL delivering a good value for the checks you are writing?

Probably not.

At the very least, they cannot all be delivering equal value back to the payer.

And therein lies the opportunity to promote your specialty space.

For illustrative purposes, let’s assume you own an urgent care clinic.

With “class differentiation,” you are looking to highlight that urgent care clinics provide a great value to the payer.

You are NOT looking to show that your specific urgent care – the one you own – provides a great value to the payer (yet J).

How can you do this?

Here are several ways:

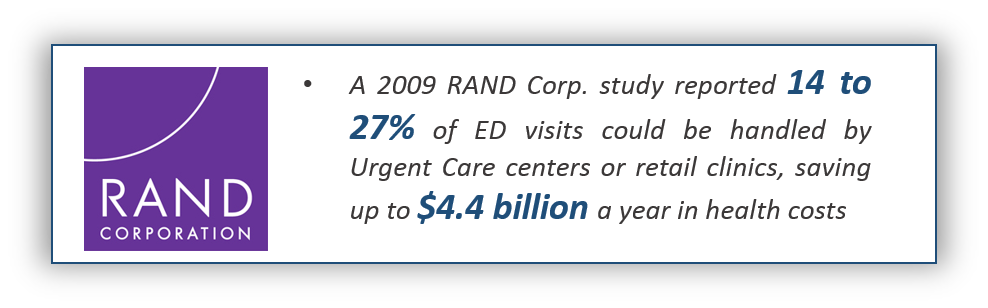

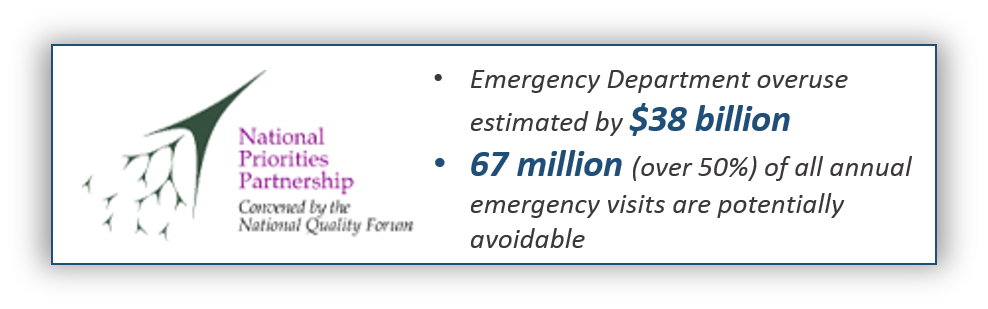

- Find published research that highlights the value urgent care clinics deliver (e.g., avoiding ER and hospital visits)

- Find information / publications that highlight key payers supporting urgent care services (e.g., in their own newsletters to their membership)

- Find information / publications that highlight all the value urgent care clinics offer to patients (e.g., access beyond their primary care, high patient satisfaction)

Here are a couple of examples:

CONCLUSION

In this PART 2 article of a 3-part series, we continued to examine a textbook case of how Pharma builds and proves value to payers in efforts to gather insights of how we can do the same for our independent medical clinic.

We learned how after “making it matter” to payers, “class differentiation” can be a powerful tool to begin to position a product as the solution to the problem payers have.

In “class differentiation,” we are looking to highlight the value of the category of medical services we deliver, not our individual business (yet). We are looking to demonstrate to the payer that among all of the various healthcare products and services to whom they pay bills, their relative ROI with our type is particularly valuable.

If we run an urgent care, we look for research that highlights the value of urgent care clinics to the payer. If we run a physical therapy clinic, we focus our research effort there. If we run a primary care practice, we look for that kind of data.

In it all, we are emphasizing with the payer that our branch in the healthcare deliver chain is valuable to them and delivers great clinical outcomes and economic outcomes.

Now that you have learned the key principles of “Making It Matter“ to the payer and “Class Differentiation,” it is time to move to PART 3 in our series – “Product Differentiation.”

Click HERE to go to PART 3 of 3 – Product Differentiation…

Ultimately, we are working to build a payer value proposition for our independent medical practice. You can download a FREE copy of our introductory step-by-step guide and other tools HERE.